can i gift more than the annual exclusion

That amount is called the annual exclusion. That still doesnt mean they owe gift tax.

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

In 2019 the annual exclusionary gift is 15000.

. If your spouse is not a US. Likewise what is the gift tax limit for 2020. Even there that figure currently 15000 has less significance than it used to have.

Gifts that are not more than the annual exclusion for the calendar year. Citizen the marital deduction for gifts is limited to an annual exclusion of 164000 for 2022. However if your gift exceeds 16000 to any person during the year you have to report it on a gift tax return IRS Form 709.

Even better if you contribute more than the 16000 annual exclusion amount to a 529 plan for any particular beneficiary you are allowed to spread as much as 80000 five times the annual exclusion amount over. Spouses splitting gifts must always file Form 709 even when no taxable gift is incurred. Thanks to the annual gift tax exclusion in 2021 you can give each of these family members 15000 a total of 150000 without owing any gift tax.

You can make individual 16000 gifts to as many people as you want. The gifts might not be. Likewise what is the gift tax limit for 2020.

Irrevocable gifting trusts can be used for annual exclusion gifts and are highly recommended for larger gifts greater than the annual exclusion amount that require a Gift Tax Return Form 709. In 2018 the annual exclusion will be 15000 in 2017 it is 14000. Annual Gift Tax Exclusion.

More specifically if the combined fair market value of all gifts in a. Annual exclusion gifts are usually in the forms of cash stocks bonds portions of real estate or forgiving debt on a family loan in an. This limit does not apply to charitable giving or to gifts between spouses.

This represents the maximum amount that can be given on an annual basis without diminishing the lifetime exclusion amount which currently is 5430000 for 2015. An annual exclusion gift is a gift that can be included in the donors yearly exclusion. You can gift up to the annual exclusion limit for each separate recipient and theres no restriction on the number of recipients you can gift to each year.

In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. Tuition or medical expenses you pay for someone the educational and medical exclusions. To maximize these tax benefits give 15000 to each recipient in December 2021 then give 16000 to each recipient in January 2022.

The annual exclusion is a tax benefit that taxpayers can use when giving a gift that exceeds the exclusion amount. It is clear that if my client has never made gifts exceeding her annual exclusion her full applicable credit amount is available to her. The annual gift tax exclusion is 16000 per recipient in 2022 32000 for a married couple giving jointly and 15000 in 2021.

The annual gift tax exclusion For 2020 the annual exclusion is 15000 per person same as it was in 2019. Some examples of situations that could trigger someone having to file a gift tax return include. Once you give more than the annual gift tax exclusion you begin to eat into your lifetime gift and estate tax exemption.

Gifts that are not more than the annual exclusion for the calendar year. The annual gift exclusion limit applies on a per-recipient basis. You just cannot gift any.

Contributing more than 16000 in a year to your grandchilds 529 plan. There is even an advantage in her making gifts exceeding the applicable credit amount in. There can be tax issues relative to an idea called basis and there is something called the annual exclusionary gift that requires some explanation.

Contributions to 529 plans Coverdell ESAs and UGMA UTMAs are all treated as gifts subject to annual exclusion amounts. The gifts also reduce your taxable estate by 150000. Every year the IRS sets an amount of money that a gift-giver can give to a recipient free from taxes.

It also represents the maximum amount that can be given without triggering the need to file a gift tax return. We can prepare a gift tax return or returns for you if more than 15000 is being given to a single individual in any year Unified credit for taxable gifts. For example lets say this years annual gift tax exclusion amount is 15000.

If a single adult gifted one child 10000 in January and gave that child another 10000 in October. 12 hours agoThe Victorias Secret Semi-Annual Sale 2022 is looking better than ever featuring discounts on your favorite bras thongs lingerie sleepwear swim and more. So here is how it goes.

We may want to give our kids or other loved ones the sun the moon and the stars but once they are no longer our dependents for tax purposes we cannot give them more than 15000 per year in 2019 without potential gift tax consequences. Tuition or medical expenses you pay for someone the educational and medical exclusions. If someone gives you more than the annual gift tax exclusion amount 15000 in 2019 the giver must file a gift tax return.

The annual exclusion for 2014 2015 2016 and 2017 is 14000. So if she makes taxable gifts exceeding the annual exclusion of 650000 this year she will owe no gift tax. This gift tax limit isnt a cap on the total sum of all your gifts for the year.

Irrevocable gifting trusts can be used for annual exclusion gifts and are highly recommended for larger gifts greater than the annual exclusion amount that require a Gift Tax Return Form 709. How the gift tax is calculated and how the annual gift tax exclusion works. 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift.

The 60 best Fathers Day gift. Because more than 15000 is being transferred by a spouse a gift tax return or returns will have to be filed even if the 30000 exclusion covers total gifts. Fortunately your 16000 annual gift tax exclusion can be used to keep your 529 contributions from becoming taxable gifts.

Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022. Gifts to your spouse who is a US. The annual gift exclusion limit applies on a per-recipient basis.

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Planning For Year End Gifts With The Gift Tax Annual Exclusion Somerset Cpas And Advisors

Connecticut Gift Tax All You Need To Know Smartasset

Giving While Living Do You Understand The Gift Tax

Annual Gift Tax Exclusion A Complete Guide To Gifting

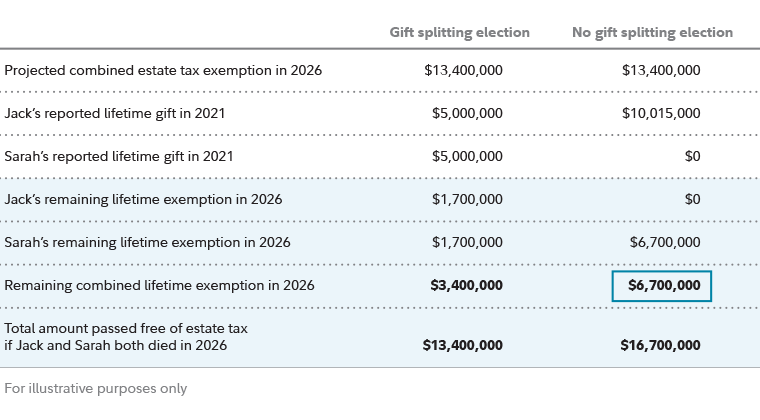

Estate Planning Strategies For Gift Splitting Fidelity

Annual Gift Tax Exclusion Explained Pnc Insights

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

How Does The Gift Tax Work Personal Finance Club

How Can I Save On Taxes By Gifting Cash To Others

How Much Money Can You Gift Tax Free The Motley Fool

The Annual Gift Tax Exclusion H R Block

Estate And Gift Tax An Overview Findlaw

California Gift Taxes Explained Snyder Law

/christmas-cash--wad-of-american-currency-tied-with-red-ribbon-611319628-ab2093a9addf4a46b6a54817e5eaee21.jpg)

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)